Digitising through inclusion

| Client | Banco Azteca |

| Where | México |

| What | Banking |

| When | 2019 |

Installation of 800 new ATMs ------ Inclusive redesign ------ Augmented reality testing ------ More than a 100 interviews ------ 58% increase in satisfaction rate

01

THE CHALLENGE

A population with an aversion to banks

Banco Azteca needed to reduce saturation in its human attention channel by boosting the use of the ATM and app in the context of a population that is not very digitized and reluctant to interact in this medium.

A challenging context that became an opportunity to boost the upskilling of the population through a pleasant and affordable user experience.

Bringing the population closer to and eliminating their fear of ATMs

A change in the user experience was needed to make it more comfortable and friendly and to encourage the use of the ATM.

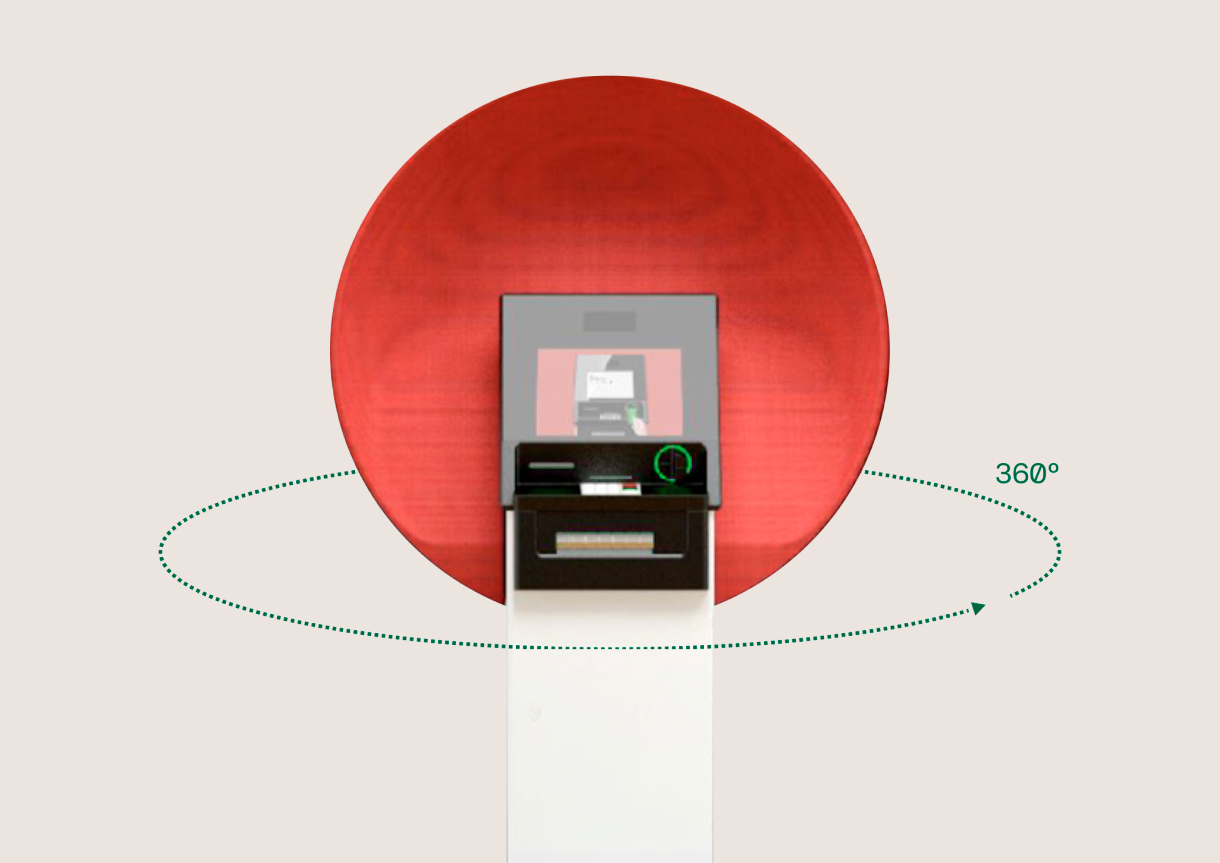

We decided to start from the foundations of the process and transform one of the pillars of customer service: the ATM itself.

02

THE SOLUTION

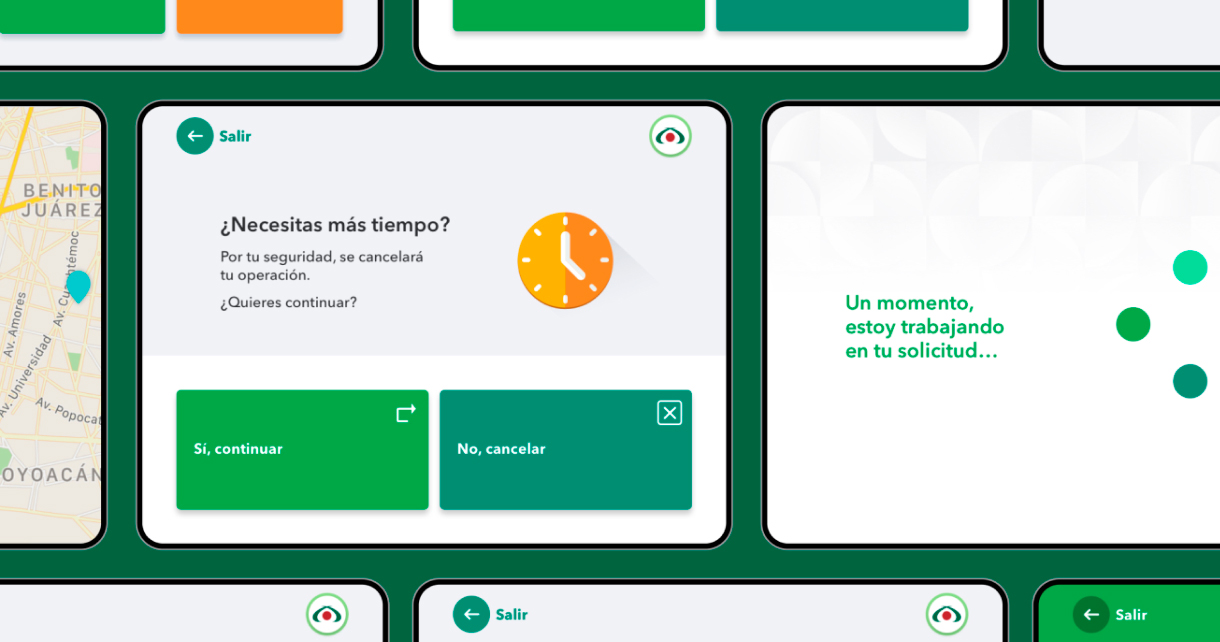

Augmented reality to design the best ATM in all of Mexico

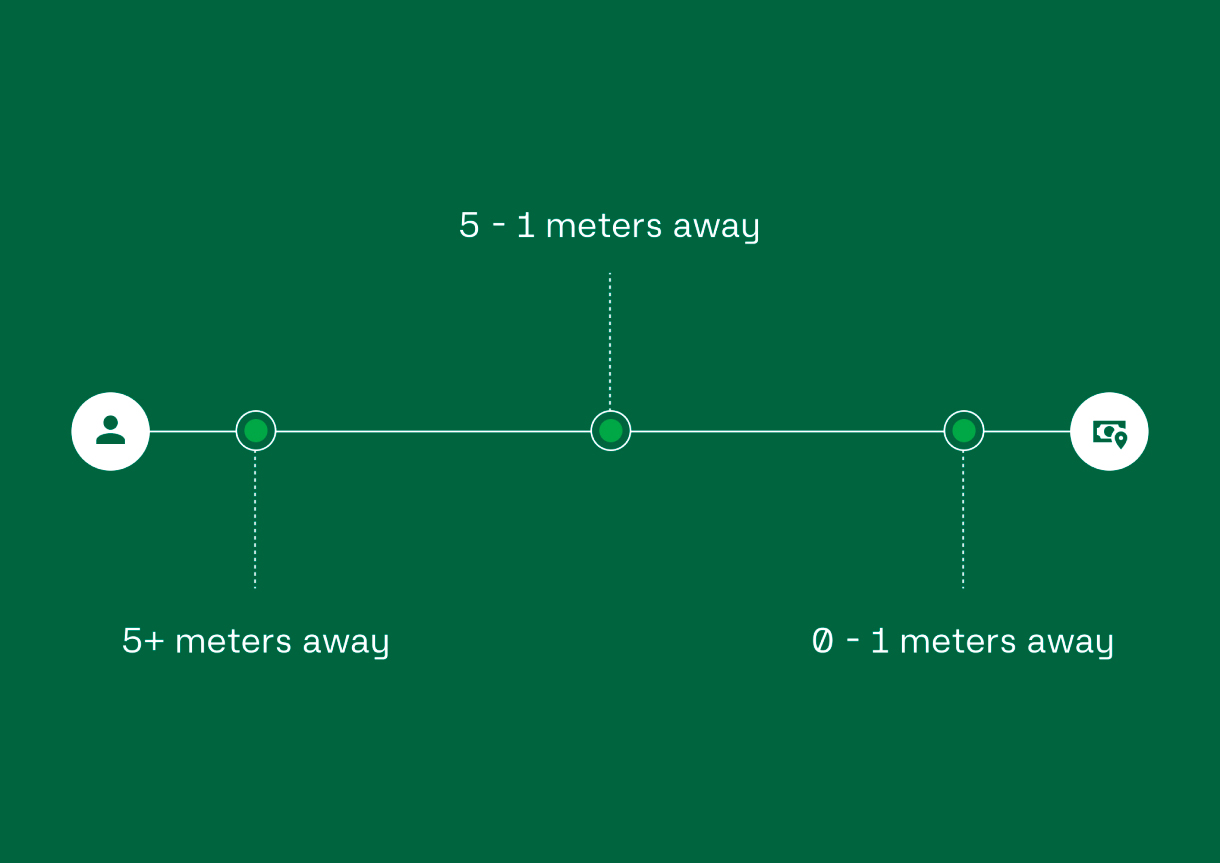

We travelled over 3000 km with more than 100 users to improve the banking experience. Our goal: an empathetic and inclusive interaction, eliminating fear of using the ATM.

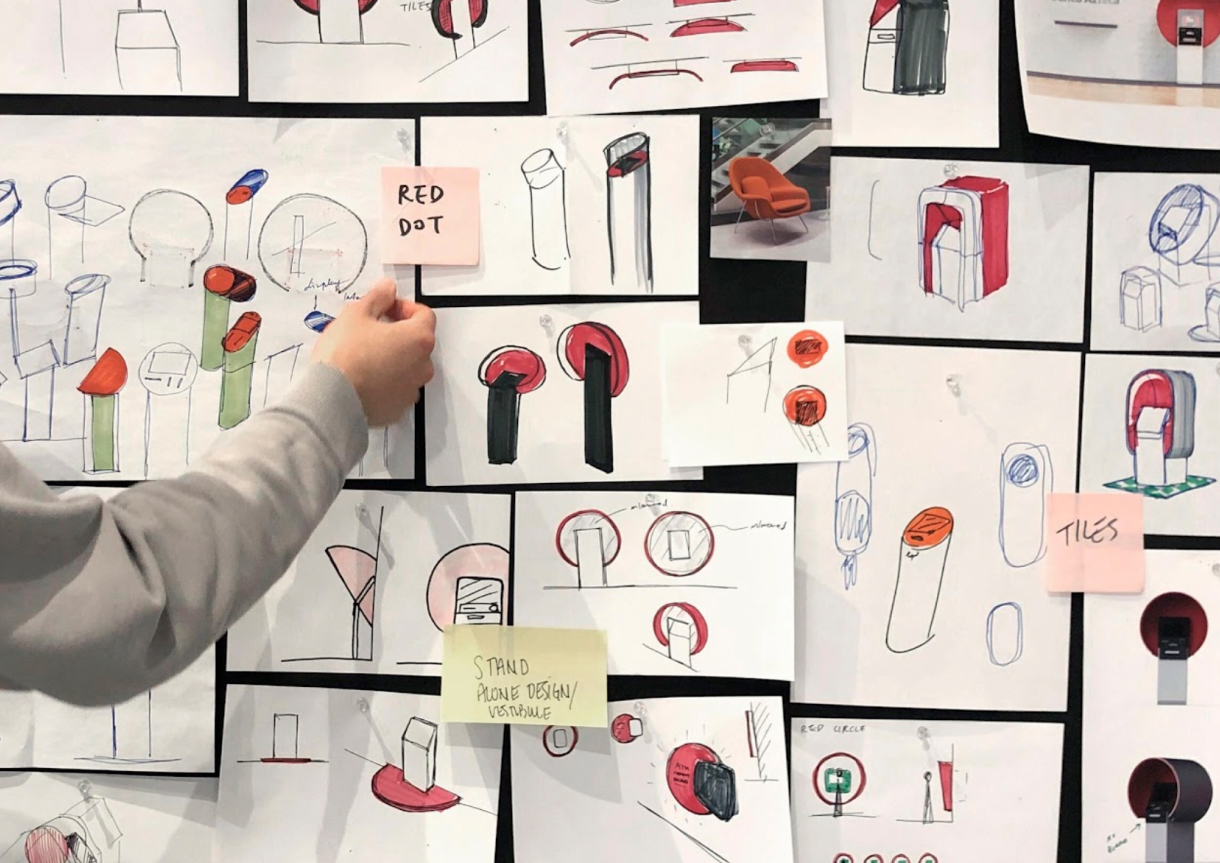

The ATM was designed to assist inexperienced users. By listening to consumers, we created hundreds of prototypes until we developed one that addressed common fears, such as losing money or breaking the machine.

"If you make it useful and make it kind, you eliminate fear"

Andrés Aymes Ansoleaga - CEO Banking Mexico

TIMELINE

2018

Feb. 2019

Mar. 2019

Jun. 2019

Banco Azteca wins a tender in 2018 to handle foreign exchange from the US, thus needing to free up dependence on its human attention channel in Mexico.

We began to travel throughout Mexico conducting interviews in dozens of locations to take into account the opinions of people from all backgrounds. We also visited Banco Azteca ATMs to understand the experience of using them.

We started designing hundreds of ATM and interface prototypes and tested them through Augmented Reality.

More than 800 new ATMs were installed throughout Mexico and transactions increased to 11 million per month. User satisfaction grew by 58% thanks to a new empathetic, inclusive and cohesive banking experience.

MAIN CONCLUSION

We redesigned and implemented Banco Azteca's systems and experience

Inspired by Mexico for Mexicans

We gave Banco Azteca's ATM an identity as an interface that reaches out to a population with a distrust of banks to introduce them to finance. In this way, we turned the ATM into a modern tool for empowerment in the transition to the digital world, which does not even exclude people with less financial knowledge.

800+

new ATMs installed

A new ATM network with Banco Azteca's new systems and designs.

11M

of transactions per month

The new digital experience enhances usage through the new ATM network.

58%

increase in satisfaction

The new, more inclusive design enhances the experience and satisfaction.

More cases